Student Loan

Recovery Solutions

Consistent, Proactive & Proven Results

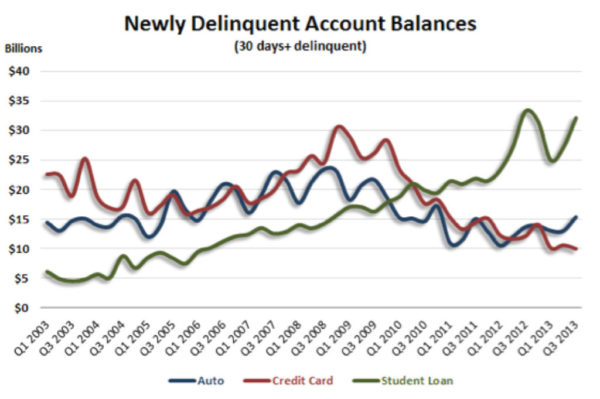

Outstanding student loan balances now easily exceed $1 trillion – falling second only to mortgage. Not only is student loan debt on the rise, borrowers are going delinquent at a faster rate than other loan types. In third quarter 2013, student loans had the largest total balance of newly-delinquent accounts (defined by the Federal Reserve Bank of New York as 30+ days past due).

The only way to manage this type of debt is to expect and plan for more delinquencies. With over 30 years of industry expertise, our recovery solutions are uniquely managed and supported by professionals who understand the collection nuances and challenges facing the education industry today. Whether you’re seeking full-service outsourcing or stage-specific assistance, we can provide you with affordable, proactive solutions to help you recover more.

Source: “Why Everyone Keeps Talking About Student Loans.” InsideArm.com. December 2013.